JAMAICA — While much of the city has recovered from the 2008 housing crisis, a disproportionate number of black homeowners in southeast Queens are still struggling, according to data analyzed by the Center for New York City Neighborhoods.

“Black homeowners in particular are facing a crushing reality: many often owe more on their mortgages than their property is worth,” the report said.

"For home-owners who bought in the early 2000s, white home values have recovered while black home-owners have lost net wealth in that time," said Leo Goldberg, a senior policy analyst at the Center for New York City Neighborhoods.

The hardest hit area of all is southeast Queens, particularly Jamaica.

“Jamaica is one of the only parts of the city where home values are lower than they were before the recession,” Goldberg said.

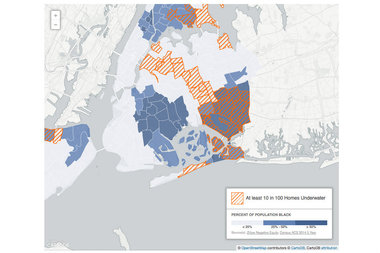

The data focuses on areas of the city where the majority of homeowners are black and where more than 10 percent of homes with a mortgage are underwater, meaning value of the loan exceeds the market value of the house. Large swaths of the Bronx and Queens, as well as parts of Staten Island are highlighted.

(Map courtesy of Center for New York City Neighborhoods)

In Manhattan, where the median price for an apartment passed $1 million in 2015, there are no areas where more than 10 percent of mortgages are underwater.

Many of the people underwater on their mortgages took out subprime loans in the early 2000s and have struggled to pay them back since the housing bubble burst in 2008.

“Some of these homeowners have been able to keep these homes with loan modifications,” Robert Tilley, a foreclosure counselor at Neighborhood Housing Services in Jamaica, said. “But in some of the cases with balloon payments or deferred balances … there may be cases where people are never in the position to gain equity by the time they sell their home.”

Tilley said that most of the mortgage owners he works with are people of color. Many are low-middle income, but there are also middle income people who he said were steered into higher cost loans. Many of these people will be affected well into retirement.

“We have senior citizens who are in their late 60s and early 70s, couples who are working who can’t afford to retire because of this problem,” Tilley said.

“It’s kind of this American dream thing, purchasing a home is a way of building wealth and if you got one of these homes and you’re now upside down and underwater, you don’t have wealth,” Tilley said. “It may be many years before someone is in a position to be right side up again.”

Homeowners having trouble with their mortgage can call the Homeowner Hotline at 855-466-3456 to receive references to free and vetted legal services and counseling.